Activity-based costing is a process of calculating the cost of products that accounts for indirect costs. It increases understanding of overheads and cost drivers.

The goal of activity-based costing is to assign specific resources to objects.

. Activity-Based Costing is a method of assigning indirect and overhead costs to each of your products or services - giving you a better idea of their actual costs. This is different to traditional time-driven activity-based costing which assigns a more generalised percentage of these costs to a broader production measurable like a run of a. Of activities to arrive at a profit.

Activity-Based Costing Benefits. The ABC system works by identifying activities in an organization. And makes costly and non-value adding activities more visible allowing managers to reduce or eliminate them.

Activity based costing systems are more accurate than traditional costing systems. It identifies the activities in the organization such as the purchase of material is an activity of purchase requisition follow up from the. This method paints a clearer picture of where a companys money is going and can help the business to trim expenses or more accurately price its goods.

It divides the overheads into different cost pools and then allocates them. The ABC method allocates direct and indirect costs to goods and services. Recording and classification of all costs.

Activity based Costing ABC is a systematic cause effect method of assigning the cost of activities to products services customers or any cost object. Activity-based costing or ABC costing is an accounting method that allocates product costs based on activities that are used by cost objects. Activity Based Costing is being introduced to solve the costing problems associated with the traditional costing method.

Following steps need to be followed in the calculation of activity based costing. Apportionment of related to overheads to the cost drivers. Activity-based costing also known as ABC costing refers to the allocation of costs charges and expenses to different heads or activities or divisions according to their actual use or on account of some basis for allocation ie.

It increases understanding of overheads and cost drivers. It specifically identifies the activities that cause production costs to increase helping. Calculating the rate of cost drivers.

Activity-based costing provides a more accurate method of productservice costing leading to more accurate pricing decisions. It is that costing method in which costs are first attributed to activities and then to products. Activity-based budgeting ABB is a budgeting method where activities are thoroughly analyzed to predict costs.

Those activities are then assigned a cost to each product or service. Identification of the activities producing the overhead cost. This costing system is based on the premise that activities are responsible for the incurrence of costs and create the demands for resources.

ABC costing is an approach to monitoring and costing business activities. And makes costly and non-value adding activities more visible allowing managers to reduce or. ABC costing identifies production costs linked with each activity.

Activity-based costing provides a more accurate method of productservice costing leading to more accurate pricing decisions. In addition to helping track overhead costs an ABC system allows better understanding of activity and facility costs insight into profitability. Activity-based costing ABC is a method to determine the total cost of manufacturing a product including overhead.

Activity-based costing is a process whereby you can assign operational costs and overheads to the specific products or services that they relate to. What benefits does ABC provide. This approach involves tracing the consumption of resources and costing final outputs.

Its mostly used in manufacturing as its much easier to work out the cost of all the activities required to make a certain product in this industry. There are three main steps in ABB. Thus it allocates production costs in further detail as compared to other costing approaches.

This model assigns more indirect costs overhead into direct costs compared to conventional costing. Activity-based costing is an accounting method that assigns costs to the different activities involved in making a product in order to allocate a companys funds in a fair way. Once costs are assigned to activities the costs can be assigned to the cost objects that use those activities.

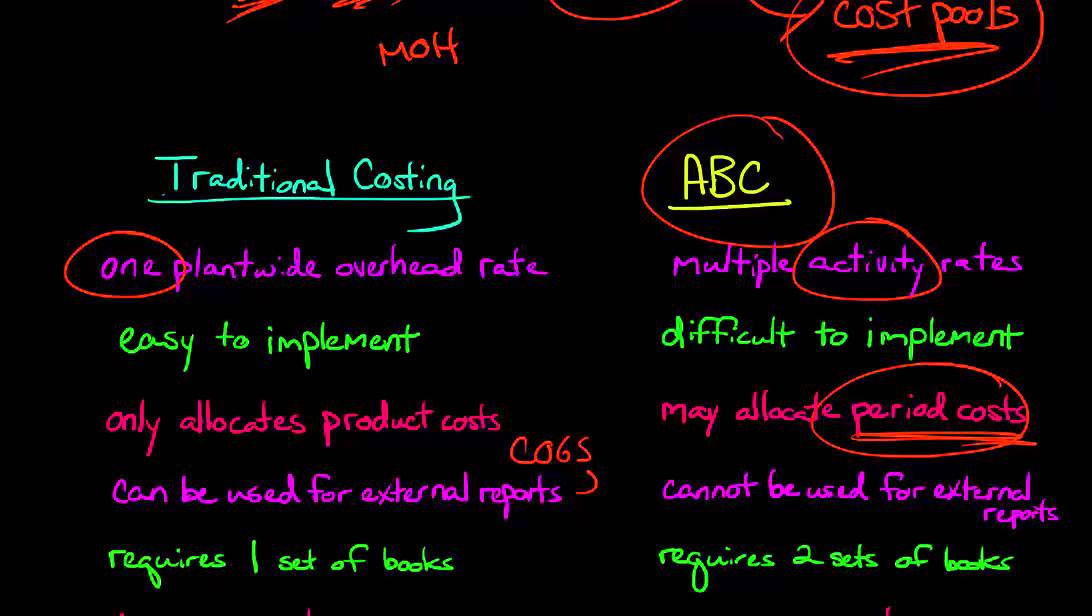

It is calculated by taking the cost pool total and dividing it by the cost driver. The activity-based costing process. However ABC systems are more complex and more costly to implement.

ABC is based on the principle that products consume activities. ABB is better suited to new businesses that lack historical costing data that more established businesses have. Activity-based costing is also known as ABC costing.

The system can be employed for the targeted reduction of overhead costs. Traditional cost systems allocate costs based on direct labor material cost revenue or other simplistic methods. Identifying cost drivers projecting total units and estimating the cost per unit.

Steps in activity based costing. The leap from traditional costing to activity based costing is difficult. Activity based costing ABC is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each.

Therefore this model assigns more indirect costs overhead into direct costs compared to conventional costing. Although This Is The 16th 2022 Activity Based Costing At UPS Activity Based Costing At UPS Is A Crossfunctional Discipline Requiring An Understanding Of Our Work Activities. Activity-based costing is a costing method that focuses on activities performed to produce products.

It is a process of tracking resource use and pricing final outputs. Cost driver rate which is calculated by total cost divided by total no. Activity-based costing ABC is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each.

It is a costing system that focuses on activities performed to make goods. This is because they provide a more precise breakdown of indirect costs. Activity-based costing ABC is a methodology for more precisely allocating overhead costs by assigning them to activities.

Activity Based Cost Overview Collaboratively Finance And Accounting Engineering IT And Operations Produced A Series Of ABC Models At UPS. The definition of activity-based costing is a management accounting approach to the costing and monitoring of activities which involves identifying the activities the bring about specific costs. Identification of cost drivers.

4 2 Activity Based Costing Method Managerial Accounting Managerial Accounting Revision Guides Activities

Cost Management Plan Example Templates Cost Accounting Abc Activities Key Performance Indicators

Activity Based Costing Abc Cost Accounting Accounting And Finance Financial Management

Pin On Strategy Marketing Sales

Infographic Activity Based Costing Ca Student Blog Education Icas Activities Infographic Education

Activity Based Costing Arrow Diagram Http Www Poweredtemplate Com Powerpoint Diagrams Charts Ppt Business Models D Diagram Chart Powerpoint Charts Powerpoint

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Cost Accounting Financial Freedom Quotes Abc Activities

Activity Based Costing Abc Vs Traditional Costing Activities Cost Accounting Traditional

Activity Based Costing Accounting And Finance Accounting Principles Financial Strategies

Unit 5 Activity Based Costing Study Objectives Recognize The Difference Between Traditional Costing And Act Cost Accounting Powerpoint Presentation Education

What Is Behind The Activity Based Costing Activities What Activities Base

Cost Hierarchy Meaning Levels And Example Accounting Education Accounting And Finance Accounting Basics

Activity Based Costing Activities Cost Accounting Accounting Principles Pool Activities

General Activity Based Costing Explanation Video Managerial Accounting Activities What Activities

Activity Based Costing Abc Activities Activities Infographic

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation In 2022 Business Budget Template Bookkeeping Templates Cost Accounting

3d Activity Based Costing Donut Diagram Http Www Poweredtemplate Com Powerpoint Diagrams Charts Ppt Process Diagrams Powerpoint Charts Diagram Diagram Chart

Activity Based Budgeting Budgeting Accounting Principles Financial Management

Activity Based Costing Abc In Excel Abc Activities Activities Abc